Video: Secretary Sebelius to spend more

time in Texas to increase number of

residents signing up for health care

(KTRK 13 News)

Becca Aaronson, Texas Tribune

Enrollment in the federal health insurance marketplace continued to steadily climb in January, according to data the U.S. Department of Health and Human Services released Wednesday. In January, another 89,500 Texans selected a health plan on the insurance marketplace created by the Affordable Care Act, the department reported.

“Today’s enrollment figures are more proof that Texans are ready and willing to push past the barriers that Gov. Perry has put in the way of the new Health Care law,” Ginny Goldman, executive director of the Texas Organizing Project, which is assisting enrollment efforts across the state, said in a statement.

As of Feb. 1, the total number of Texans who have enrolled in a health plan jumped to 207,500 from 118,000 at the end of 2013. Across the nation, enrollment grew to 3.3 million, a 53 percent increase over enrollment in the previous three months.

“These encouraging trends show that more Americans are enrolling every day, and finding quality, affordable coverage in the Marketplace,” U.S. Health and Human Services Secretary Kathleen Sebelius said in a statement.

President Obama’s signature health reform law requires most Texans to have health insurance by March 31. Texas’ Republican-dominated Legislature, which staunchly opposes the federal health law, declined to establish a state-based insurance marketplace, so the federal government has done so instead. Additionally, the Texas Department of Insurance issued state regulations that added training and other requirements for navigators hired and trained by recipients of federal grants to help people enroll in the health marketplace.

Texas has the nation’s highest rate of people without health insurance at 24.6 percent, according to U.S. census data. About 48 million Americans — including more than 6 million Texans — were uninsured in 2011 and 2012.

California and New York, which established state-based insurance marketplaces, have enrolled 728,100 and 211,300 people, respectively. Florida, which has enrolled 296,900 people, is the only state participating in the federal marketplace with greater enrollment than Texas.

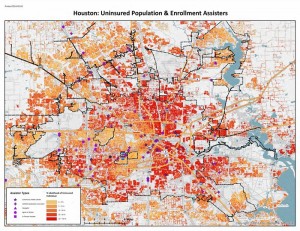

Local government officials and community-based organizations in Texas are working together to incorporate new rules, maximize their resources and educate uninsured residents on how to take advantage of the federal law.

Texas has been a priority state for enrollment efforts, said Julie Bataille, communications director for the Centers of Medicaid and Medicare Services, and they’re working closely with local organizations and government officials to assist enrollment efforts.

“A lot of the activities that we’re doing in Texas in particular, understandably, are focused on reaching citizens who speak both English and Spanish,” she said.

John Davidson, a health policy analyst at the conservative Texas Public Policy Foundation, said enrollment was strikingly low, given the total number of uninsured Texans.

“In a state with more than 6 million uninsured, you would expect more than 207,546 people would have bothered to sign up after four months of open enrollment,” he said in an email. “This suggests that many Texans do not think the exchanges plans are all that good of a deal after all.”

But Phillip Martin, deputy director of the left-leaning Progress Texas, said that it took Texas four years, from 2006 to 2010, to achieve a similar spike in enrollment on its own — 232,000 children — in the Children’s Health Insurance Plan.

“In the past, it took years to see the kind of health coverage expansion in Texas we’ve seen in the last few months thanks to the Affordable Care Act,” he said in an email.

The federal data does not indicate how many of those who’ve enrolled in health plans on the federal marketplace were previously uninsured, or how many people have paid premiums on health plans selected on the marketplace.

Instead, the department’s figures break down enrollment numbers by gender, age, type of health plan selected and whether individuals received financial assistance. As this animation explains, the plans offered in the federal marketplace are tiered.

In Texas, the majority of those who have enrolled, 56 percent, are female. Seventy-three percent of the 163,800 Texans who received financial assistance, or tax credits, to help pay premiums on a private plan, purchased a middle-tier Silver plan. Meanwhile, most of the 43,600 who did not receive tax credits, 37 percent, purchased lower-tier Bronze plans. Twenty-five percent of those who did not get the credits purchased a Silver plan.

While critics of the law have raised concerns that the greater number of women enrolling in marketplace plans could raise premium rates for everyone, Bataille said that was not a concern for the department.

“We believe that we have work to do so that every American, young or old, who wants to enroll in quality affordable coverage will be able to do that,” she said.

Among the Texas enrollees, 27 percent are between ages 18 and 34, while 49 percent are between the ages 45 and 64. In comparison, 25 percent of enrollees nationally are ages 18 to 34, and 54 percent are between 45 and 64. Health care experts have said the number of young Americans who enroll could impact the quality of the insurance risk pool, and inevitably, premium prices for everyone.

“That does not bode well for exchange premiums in 2015,” Davidson said, “which will rise sharply if there is a disproportionate number of older enrollees.”

____________________________________________________

This story originally appeared in The Texas Tribune