(KTRK 13 News)

Mike Morris, Houston Chronicle

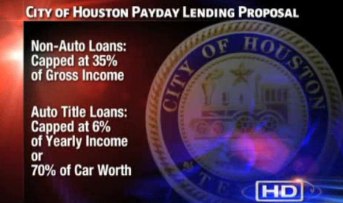

Houston officials laid out proposed restrictions on payday and auto title lenders Tuesday, drawing tepid support from the industry and disappointment from advocates who say the rules would not stop the spiral of debt for many low-income borrowers.

The Texas Legislature discussed regulating payday lending in 2011, but met stiff industry resistance and made little progress. Since then, Dallas, Austin, San Antonio and El Paso have adopted regulations. Dallas and Austin have been sued over their restrictions.

Houston leaders say they will wait to see whether the Legislature acts during its current session before voting on their proposal. Mayor Annise Parker has said the industry “cries out for regulation” and called the state’s failure to do so “disgraceful.”

“Restrictive regulation is needed to curtail the abusive practices that can be found within the industry, and to reduce the cycle of debt that is imposed on the economically disadvantaged,” City Attorney David Feldman said. “On the other hand, it needs to be recognized that payday loans are often the only source of credit that these very same consumers have access to. Overly restrictive regulations can reduce the availability of the source of credit for those who need it the most.”

Payday lending involves small loans made on a short-term basis that avoid legal caps on fees and interest that apply to mainstream lenders such as banks, Feldman said. Title loans operate similarly and are secured by the borrower’s car title, leaving the vehicle at risk for repossession.

Texas’ average payday loan of $300, if refinanced or “rolled over” nine times, would see the borrower pay $840 on the $300 principal, Feldman said. In the 10-county Houston region – home to about a fourth of the state’s 3,400 such lenders – data show borrowers refinance more often and pay on time less often than state averages. Statewide, 40 percent of borrowers roll their loans over at least five times, Feldman said.

Northeast Houston resident Evelyn Hatchett said she has paid $4,000 on a title loan of $1,500 and still had her car repossessed last fall. “You’re just giving them free money,” she said. “It’s all just fees. It doesn’t touch the principal amount.”

(Read more at Chron.com)

LOCAL AREA HEADLINES:

- Local War veterans share experiences with PTSD (KPRC 2 News)

- Spring neighborhood concerned about proposed low-income housing project (KTRK 13 News)

- Houston area receives mixed ratings in top safest cities report (Chron.com)

- Our children at risk: Security cameras at public schools broken for months (KHOU 11 News)

- METRORail’s north line expansion faces more delays (KTRK 13 News)

- Fed judge blasted for ‘outlandish racial comments’ (KHOU 11 News)

- Doctors say ‘accidental miracle’ helped Cypress teen beat cancer (KHOU 11 News)

- Houston Looks At Ways to Bring Fresh Food To Underserved Neighborhoods (KUHF Public Radio)

STATE, NATION & WORLD:

- CPRIT Founders Lay Out Reform Legislation (Texas Tribune)

- Finding Water Amid Drought: Legislature Considers Options (State Impact Texas)

- Cuts led to Texas family planning clinics closing (News 92 FM)

- Slaying of famous sniper highlights dangers of ‘gun therapy’ to help troubled veterans (Washington Post)

- Bipartisan House group pushes gun trafficking bill (USA Today)

- As Obama calls for short-term fix to avert sequester, CBO reports falling deficits (Washington Post)

- Boy Scouts Debate Accepting Gays; Pentagon May Extend Some Benefits (NPR)

- Obama Speech Expected To Flesh Out Climate Proposals (NPR)

- Tsunami kills at least five in Solomons after big Pacific quake (AlertNet/Reuters)